Most Read

Beware of Bitcoin Ponzi Schemes: Red Flags to Watch Out For

How to Tell if Nikes Are Fakes: From Tags to the Stitching

Real Chase Fraud Text Alert or Scam Message?

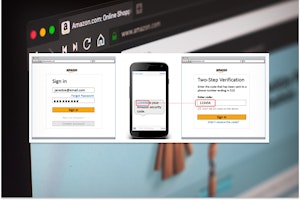

Received an Amazon OTP Text? It Could Be a Scam

How to Spot Fake Air Force 1s: 7 Signs of a Fake

Ponzi Schemes In Depth

- What Are Ponzi Schemes?

- How Ponzi Schemes Work

- Largest U.S. Ponzi Schemes

- Most Common Types of Ponzi Scheme

- Ponzi Scheme Red Flags

- How to Beat Ponzi Scams

- Fallen Victim to a Ponzi Scheme?

Ponzi schemes are some of the most popular types of scams out there, always seeming to come back in one way or another over the years. But what exactly is a Ponzi scheme, how can you detect one, and what can you do if you’ve fallen victim to one of these plots?

What Are Ponzi Schemes?

The term Ponzi scheme originated around 1920, with a grifter named Charles Ponzi having the honor of the scam being named after him. But these types of schemes were around long before Ponzi got involved, with the first officially-noted instance taking place in the mid-1800s.

For his part, the original Ponzi involved the U.S. Postal Service, promising investors significant returns on pricey international postage. Ponzi claimed that he could buy and sell international postal reply coupons, kind of like a postage reply envelope. His story to investors was that he could buy coupons in bulk from overseas at a significant discount, then sell them in the U.S. for a quick profit.

He claimed that investors could make 50% profit in 45 days and 100% in 90 days. However, he did not invest any of the money in coupons. Instead, he delivered on his promise of handsome profits by using money from new investors to pay existing investors. His success was self-fulfilling—investors that had profited helped recruit new investors, so the scheme grew.

Ponzi was eventually convicted of mail fraud and jailed in 1920.

Ponzi schemes can be very difficult to detect. The lure of what appears to be a proven track record, significant returns in a short amount are so tempting and are the main reason why this type of scam has been around for such a long period of time.

"Don't invest in something that you don't understand"

Warren Buffet

Warren Buffet, the billionaire investor, uses the mantra "don't invest in something that you don't understand." This advice couldn't be more relevant to protect yourself against Ponzi schemes. If the returns look too good to be true and you don't understand how the business makes money, don't invest —it could be a Ponzi scheme.

How Ponzi Schemes Work

Regardless of the institution involved, every version of Ponzi schemes follows the same general script.

Ponzi schemes start with the promise of a high—and, typically, fast—return on investment, for virtually no risk. In the case of Ponzi, investors were promised as much as a 50% return on their money in under two months.

But rather than use that money to generate the returns in legitimate ways, the incoming investments are parceled out to pay earlier investors, who are told that what they’re receiving are their own returns. Ultimately, the scammer wants to make easy money, skimming off the top of every “investment” before simply pushing the remainder forward.

Of course, to keep the cycle going, a constant stream of new investors must be tapped. This usually proves impossible, though, and at some point, most schemers will see the writing on the wall and try to take the money and run.

Alan Greenspan used the phrase "irrational exuberance" in a 1996 speech, which describes one of the key tenants of a Ponzi scheme. The concept is that when people observe other people making money (exuberance), it gives them confidence that the investment is safe (irrational). Of course, the other common feature of a Ponzi scheme is higher than average returns or better returns than you would expect from the market.

Some Ponzi schemes use exclusivity or scarcity to attract investors by having some minimum criteria to invest. This could be financial, or it could be only giving access to certain exclusive groups. All of the victims of Ponzi schemes share one thing in common, which is critical for the scheme to run successfully and that is that they are investing into something that they don't understand. This video gives a summary of the mechanics of a Ponzi scheme.

Largest U.S. Ponzi Schemes

Bernard Madoff was behind the biggest reported Ponzi scheme of all time, worth a reported $65 billion. Madoff was a prominent businessman and founder of Madoff Investment Securities. The incredible part is the scheme had been running undetected for over a decade and only unraveled when Madoff confessed to his two sons, who told the FBI.

Bernie Madoff: Madoff Investments

Bernie Madoff is infamous for the largest Ponzi scheme recorded. He conned investors out of billions of dollars over what people think could have been a 50-year period until his arrest in 2008.

Stole: $20 billion

Punishment: 150 years in prison

R. Allen Stanford: Stanford Financial Group

Using an offshore bank, Stanford stole billions of dollars from investors across the globe. Almost 30,000 investors were given fake certificates of deposits and promised huge returns.

Stole: $7 billion

Punishment: 110 years in federal prison

Tom Petters: Petters Group Worldwide

A businessman from Minnesota, Petters scammed investors out of billions of dollars after they invested in his business which promised profits from reselling retail merchandise.

Stole: $3.7 billion

Punishment: 50 years in federal prison

Scott Rothstein: Rothstein Rosenfeldt Adler

Using his law degree to his advantage, Rothstein used his law firm to convince investors to buy into several fake legal settlements.

Stole: $1.2 billion

Punishment: 50 years in prison

Lou Perlman: Trans Continental Airlines Inc., TransCon Records, Trans Continental International Inc.

The man behind 90’s boy bands ‘NSync and The Backstreet Boys stole $300 million from investors and banks, funding a business that didn’t actually exist.

Stole: $300 million

Punishment: 25 years in federal prison

Most Common Types of Ponzi Scheme

Since Ponzi schemes don’t involve selling a product, nearly all versions of this deception occur in the financial world.

Most common Ponzi schemes take the form of an “investment company” or other similar business persuading you to give them your money. Again, they’ll almost always promise you significant returns in no time—and may even deliver with some consistent payments.

Still, some scammers go out of the way to create a fake business model to fool investors further. Some recent examples include:

- Flipping expensive Broadway show tickets.

- Investing in an import/export grocery business.

- Purchasing and reselling Federal Reserve notes.

- Financing humanitarian projects around the world.

- Buying and selling securities through a brokerage account.

Ponzi Schemes vs. Pyramid Schemes

Ponzi schemes are often confused with pyramid schemes, and though the plots are closely related, they’re not exactly the same.

Both Ponzi schemes and pyramid schemes rely on a constant flow of new investments to create “profits” for previous investors, but the major difference between the two is how those new investors are found.

A Ponzi scheme typically comes down to one mastermind, posing as a “portfolio manager” or other fraudulent position. Clients approach this person with investments and collect their money when they’re ready to cash out. Meanwhile, the person in charge finds new clients and will move all the money around his- or herself.

With a pyramid scheme, that job is outsourced to the people being scammed. Investors in a pyramid scheme are incentivized and/or required to recruit new investors to keep up the cash flow. Each person joining the scheme must pay the person who recruited them, and proceeds are shared with people higher up the chain.

Ponzi Schemes vs. Multi-Level Marketing Schemes

Though multi-level marketing (MLM) investments are technically legal, MLM schemes are similar in structure to both Ponzi and pyramid schemes.

The major difference is that a Multi-level Marketing scheme involves selling an actual product, whereas pyramid and Ponzi schemes simply focus on moving money around. Still, an MLM scheme is modeled closely after a pyramid scheme, with investors still incentivized to find new recruits who will then, in turn, pay a portion of their profits forward.

Ponzi Scheme Red Flags

If there’s one silver lining about how prevalent Ponzi schemes are, it’s that the plots can be more easily detected—if you know what to look for.

Some major red flags include:

- Promises of high returns with minimal risks.

- Promises of high returns in a short period of time.

- Very consistent returns.

- Real-life investments fluctuate pretty heavily.

- An investment company that’s not registered with the U.S. Securities and Exchange Commission (SEC).

- A “portfolio manager” or investor that’s not licensed or registered with a regulating body.

- An overly complicated or secretive investment strategy.

- Might be explained away by “It’s hard to understand.”

- Account statement errors or other issues with paperwork.

- Difficulty receiving payment or cashing out.

How to Beat Ponzi Scams

Avoiding Ponzi scams, as with avoiding most unpleasant things, a good defense usually makes the best offense.

There are a few steps you can take to help stop you from getting involved in Ponzi schemes, to begin with, including:

- Researching the person or company to see if they’re registered with the SEC or the Financial Industry Regulatory Authority (FIRA).

- Going over the details of the investment with the person in charge.

- Learning about the history of the investment firm.

- Researching similar ventures to see the type of returns they offer. Compare these to those being offered to you.

- Asking for written, detailed information about the company's:

- Officers.

- Documents of previous investments.

- Financial track record.

- Guarantees, warranties, or refund provisions.

- Getting a second opinion from someone else in the financial world.

Fallen Victim to a Ponzi Scheme?

If you think you have or are currently participating in a Ponzi scheme, don’t worry. There are still some steps you can take to protect yourself.

First and foremost, you should consult with a Ponzi scheme lawyer. Choose someone who works in your state, as laws may vary by area.

It’s important to make this step discretely. You don’t want to tip off the person running the scheme.

Your lawyer should help you understand the legal ins and outs of the situation and help create a list of paperwork and documents you’ll need to pursue a case or exit the situation.

Scams Relating to Ponzi Schemes

Beware of Bitcoin Ponzi Schemes: Red Flags to Watch Out For

Don't believe everything you hear. If someone promises high returns on a bitcoin investment, proceed with caution.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

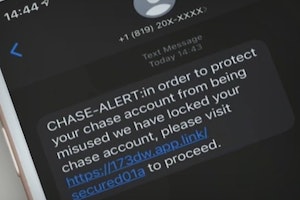

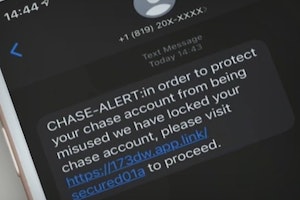

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Truist Text Alert: How to Identify a Real Text from a Scam

You may think that that Truist have sent you a text alert about your account. Here's how to check if it is actually a scam.

Wait! That Walmart Giveaway Text May be a Scam!

Fake texts are being sent to consumers claiming a hefty sum is waiting for them on a Walmart gift card, but falling for this scam puts you at risk of identity theft.

Guides Relating to Ponzi Schemes

How to Get Verified on TikTok

Securing that little blue checkmark can mean brand collabs, sponsorship opportunities, or protecting your unique content from impersonators.

How to Tell if Nikes Are Fakes: From Tags to the Stitching

Nike is one of the biggest brands targeted by counterfeiters and scammers - be extra careful with Nike products from non-official retailers as you could end up with a fake

Funeral Homes & Prices - What Are The Costs & Your Rights?

Average prices from funeral homes range between $8k to $14k and consumers are meant to be protected by a 'Funeral Rule' - what are your consumer rights?

How to View Your Amazon Archived Orders & Hide Search History

If you share your account with multiple users, archiving your past orders is a good way to keep others from seeing your orders and ruining a surprise or seeing private orders.

The Dangers of Fake THC Vapes Flooding The Market

If the health dangers surrounding vape cartridges weren't bad enough, fake THC vapes containing harmful contaminants are being sold.

News Relating to Ponzi Schemes

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.