- 15 Tips to Keep Your Money Safe

- Why Should You Protect Your Bank Account?

- Common Scams Targeting Bank Accounts

Today's scammers are on a mission to gain access to your checking account and credit card information so they can rack up several charges under your name. While it's not always easy to outsmart a scammer, some tips and tricks can keep your bank accounts secure.

15 Tips to Keep Your Money Safe

With the right knowledge and proper precautions, you can avoid the innumerable headaches associated with fraud or identity theft. From creating impenetrable passwords to regularly monitoring your bank and credit card accounts, we've compiled relevant information about how to protect your bank account from unauthorized activity and keep your bank account secure.

While banks have several security measures in place to protect you from fraud, you still need to do your part to keep your money and account safe.

1. Avoid Stand-Alone Automated Teller Machines (ATMs) or Ones in Touristy Areas

You should always strive to use ATMs associated with your bank or financial institutions, such as Bank of America or Wells Fargo, and stay away from ATMs in touristy areas or ones that look out of place.

While these machines dispense money like your typical ATM, they are more prone to tampering and are less secure. Try only to use ATMs that have security cameras installed or nearby for extra protection. In addition to not being as safe, they may also charge up to 35% of your withdrawal amount. Avoiding these machines will help you save money and lessen the chance of your data being stolen.

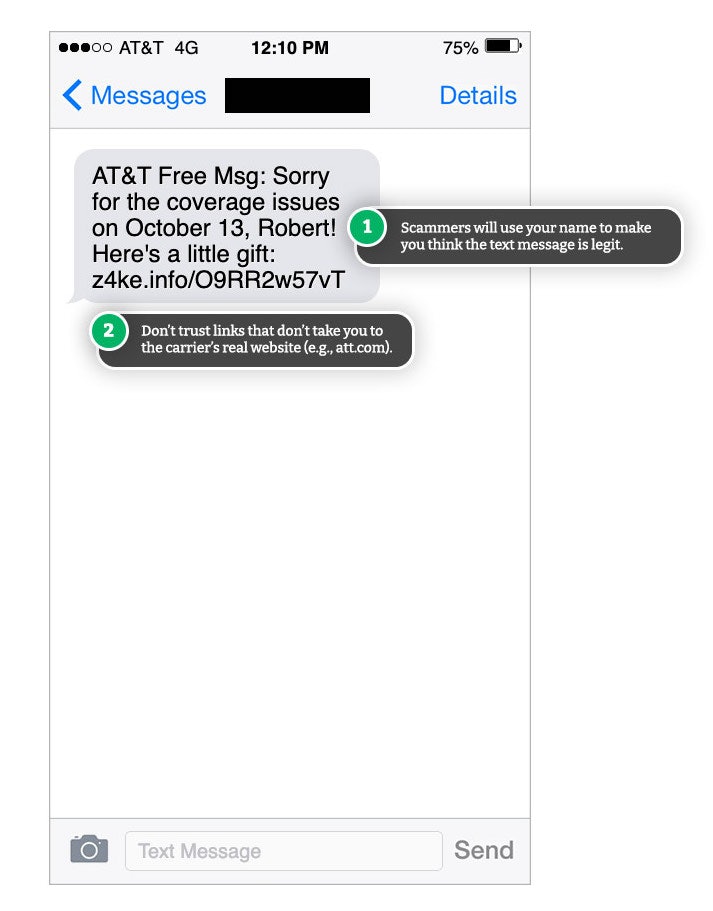

2. Be Wary of Phishing Scams and Never Click Suspicious Links

Did you know phishing is one of the most common types of fraud to gain access to your financial and personal information? Phishing scams try to convince you to reveal personally identifiable data and usually involve the scammer impersonating a brand or bank.

Some phishing emails will look like they came from your bank or financial institution, even using your bank's logo, and will ask you to log in to your online banking account and update your information. If you click a link in a phishing email, you'll unknowingly download tracking malware on your device or be sent to a fraudulent website that'll capture your information. As such, it's crucial to scrutinize all emails that require you to share personal data.

3. Scan Gas Pumps and ATMs for Skimming Devices

Some scammers use card skimmers (illegal devices attached to payment terminals) at gas pumps and ATMs to skim your debit card's magnetic strip or catch your PIN. So you'll want to check for any signs of tampering with the device, such as a loose credit card reader or a broken seal.

You can also use your cell phone to outsmart these scammers. Gas pumps and ATM scammers will often use Bluetooth to transmit card and PIN information. Turn on Bluetooth to see if there's a long string of numbers trying to connect to a device. If so, it's a red flag. However, chip technology is becoming more advanced and is making it more difficult for scammers to skim your information.

4. Monitor Your Bank Accounts Regularly

When a scammer gets access to your bank account or personal information, you'll want to act quickly. You should regularly monitor your accounts, so you're immediately aware of unauthorized charges or suspicious purchases.

Online banking makes monitoring your daily transactions easy in your checking and savings account.

You should also balance your account every month to ensure all your purchases are the ones you made. If anything appears out of the ordinary, contact your bank immediately to determine what you need to do to repair any potential damage or withdrawals from your accounts.

5. Check Your Credit Report Often for Potential Fraud

Similar to the step above, you need to check your credit report often if you want to protect your bank account from fraud and other security breaches. You should keep an eye out for any unauthorized accounts opened in your name. You can invest in a credit monitoring service from companies such as:

- IdentityForce

- Credit Karma

- PrivacyGuard

- MyFICO

Some credit card companies also offer credit monitoring services, including:

- Capital One

- American Express

- Discover

- Chase

Protect Your Credit

If your identity has been stolen or you just want to be extra careful, you can place a fraud alert or credit freeze on your credit report, so scammers can't take out any lines of credit in your name.

6. Be Careful About Which Apps You Download

Financial apps, including mobile banking apps, are becoming increasingly convenient in the digital age, allowing you to monitor your bank accounts, pay bills, deposit checks, etc. However, not all these apps have the same level of security to give you complete peace of mind.

Increase your online banking security by using your bank's official app only. You want to be careful which third-party apps are granted access to your account information. For instance, maybe you want an app or a robot to monitor your spending for you. Helpful, yes. Safe, not always. Allowing access to your account could put you at risk for fraud or even violate your bank's terms of service. Always check app ratings and do your research first.

7. Use Strong and Unique Passwords

You've probably heard this one before, or you've had your passwords declined from being too weak. Hackers are clever, and they can likely figure out your password based on the information you share online. So, you'll want to avoid using personal information, such as your name or birthdate.

While shorter passwords are easy to remember, you should opt for longer, more complex passwords with a combination of:

- Lowercase letters

- Uppercase letters

- Numbers

- Special characters

You'll also want to avoid using the same password for multiple logins. Cyclonis, a company that provides data management software solutions, found more than 80% of banking customers repurpose their passwords. Don't follow the herd here. Take the time to craft unique passwords and keep your bank account secure.

Password Managers Can Help

Are you having a hard time remembering all of your different passwords? Use a password manager to safely store, access, and create your passwords for all of your online accounts.

8. Enable Two-Factor Authentication

Two-factor or multi-factor authentication is an electronic method that grants you access to your accounts only after presenting two or more pieces of evidence to verify their identity. You've likely used this before when logging into your Gmail or bank account.

Here's how it commonly works: After entering your username and password, the site will ask for a code that has been sent to your cell phone number on file. Once you enter this code on the site, you will be able to access your account.

This provides an added level of security to protect your bank account and money—even if scammers have your login information, they won't be able to access your mobile banking or online banking account. Check if multi-factor authentication is an option with your banking institution (usually within your security settings).

9. Be Aware of Fraud Protections Your Bank Offers

As a consumer, you should always be aware of any fraud protections accompanying your debit and credit cards. According to the Consumer Financial Protection Bureau, as long as you report fraud, you have some protection and won't be liable for unauthorized charges.

You stand to lose more money if someone uses the physical copy of your card without your permission. If you report it within 60 days, you could be liable for up to $500, and if you don’t report it within 60 days, you could lose all the money in your account. Remember your protections and obligations.

- Stolen credit card number: Not liable

- Stolen credit card: Liable for max $50

- Unauthorized transaction on your checking account (debit card not stolen): Not liable (must report within 60 days)

- Stolen/lost debit card: Liable for max $50 (must report within two days)

- Unauthorized use of your physical card:

- Liable for max $500 (if reported within 60 days)

- Liable for all charges (if reported after 60 days)

- Security alert notifications via text, email, and phone on potential suspicious transactions

- $0 Fraud Liability for protection against fraud (claims subject to verification)

- CreditWise Get alerts when your TransUnion® or Experian® credit report changes.

10. Never Save Your Account Numbers on Websites

Some websites allow you to save your credit/debit card information within your profile to make it easier to order again in the future. While this method might be more convenient, this information can be stolen if that site/company is the victim of a data breach.

11. Never Share Your Personal Identification Number (PIN)

This advice may seem obvious, but it never hurts to share the message—never share your credit/debit card PIN with anyone. You don't want to share it with family, friends, or even bank tellers.

If you're ever asked to reveal your PIN, especially over the phone, hang up immediately. When you call your bank, they may first utilize an automated system to acquire your PIN and then connect you with a representative. If you receive a call from someone saying they're from your financial institution and they ask for your PIN, hang up immediately.

12. Only Make Purchases on Secure and Trustworthy Websites

As we stated before, any information you put online should be considered unsafe. Therefore, you're not 100% safe whenever you make purchases online. However, since it's nearly impossible to avoid purchasing anything online these days, there are ways you can add some additional securities for your shopping sprees.

Make sure the website you're trying to purchase an item from is secure and authentic. You want to look for websites that start with "https://" (instead of just "http://") and include the padlock symbol. If you don't see the padlock, don't enter your credit card or other financial details.

13. Pay with Credit Cards When Possible

Some of us have been conditioned to believe paying with credit cards will only rack up credit card debt. However, it may be in your best interest to use a credit card for everyday purchases to avoid putting your money at risk.

Credit cards generally have much better protection against fraud than debit cards do. If a scammer has access to your checking account, they can drain all your money. If a scammer gains access to a credit card, your money is safe, and you can contest unwanted charges with your credit card company. Additionally, credit card companies will usually block suspicious charges until you confirm they aren't fraudulent.

- Fast Account Freeze - Turn your account on/off

- Free Social Security Number Alerts (if it is found on any of thousands of Dark Web sites)

- FICO® Credit Score for Free

14. Sign Up for Banking Alerts

If you want to stay on top of your banking activity and monitor your accounts more regularly, you should sign up for banking alerts. These emails or notifications are one of the easiest ways to monitor the security of your bank account.

You should enable notifications for:

- New credit and debit transactions

- Failed login attempts

- Password changes

- Outgoing wire transfer

You should be able to activate this feature in your online banking account or by contacting your bank or financial institutions.

15. Steer Clear of Banking on Public WiFi or Shared Computers

Public WiFi is both convenient and free; however, it isn't secure. When you use public WiFi, you're opening yourself up to:

- Man-in-the-middle (MitM) attacks

- Unauthorized data transmissions

- Malicious hotspots

- Malware

- Spyware

Don't ever use public WiFi to access your banking information or enter your credit card or bank account number on a website.

Use a Virtual Private Network (VPN)

If you need to use public WiFi, a VPN can protect you from hackers and others trying to steal your information.

Why Should You Protect Your Bank Account?

Ever notice the rush of anxiety you face when you realize you've misplaced your wallet? If so, you're tuned to the avalanche of issues that spiral when someone hacks your bank account or steals your financial information.

Scammers are becoming incredibly crafty with their fraud tactics, such as sending counterfeit checks, setting up automatic debits from your account, and phishing for your information. If a scammer gets a hold of your data, they can drain money from your accounts or open new accounts in your name—and enjoy a shopping spree on your dime.

Common Scams Targeting Bank Accounts

While scammers are getting more and more creative with their money-stealing hustles, bank scams are a common way to trick people, like you, into revealing personal and financial information. In 2020 alone, the Federal Trade Commission (FTC) received more than 2.1 million fraud reports from consumers.

Common types of bank scams include:

- Overpayment scams: Someone overpays you for a product and then asks you to refund the overpaid amount. After you've done this, you will find out their initial deposit is canceled/denied.

- Fake checks: Scammers use fake checks to pay for items and take off with the product before you realize the check is no good (i.e., denied by the bank).

- Automatic withdrawal scams: Scammers gain access to your account and schedule automatic withdrawals, which may appear to you like an active subscription that you have.

- Phishing scams: Scammers use several techniques to try and steal your information, including setting up fake websites, sending emails posing as your bank, calling you asking for account information, and even sending text messages.

- Government imposter scams: Scammers pose as government officials in an attempt to steal your data and/or money. Today, one of the most commonly known scams involves scammers posing as Social Security Administration representatives.

- Fake charity scams: Scammers approach you (via phone, email, and mail) requesting donations to a fake charity.

- Employment scams: Scammers have taken advantage of the COVID-19 pandemic to scam people out of their money, offering employment at big companies for a fee.

Comments