- What Are Medical Discount Plans?

- Medical Discount Programs vs. Health Insurance

- Beware of Misleading Offers

- Frequently Asked Questions

Medical discount plans do exist and can help you save money. Unfortunately, however, some marketers and sales representatives use misleading sales tactics to trick you into buying something that won't give you any benefit at all.

The main thing to remember is that medical discount plans are not a substitute for health insurance and won't cover the costs of all of your health care services.

What Are Medical Discount Plans?

Medical discount plans are standalone plans that can give you discounts on particular health care services. You pay a monthly fee to get these discounts which vary depending on the provider, and the discount is usually limited to a list of participating providers.

They're much more affordable than health insurance plans but don't cover as much as health insurance, although it may seem like the better choice at a glance. Medical discount plans do sometimes offer discounts on medical, vision, and dental under the one plan, whereas health insurance plans usually don't include vision and dental.

You can have both a health insurance plan and a medical discount plan, but it may not be necessary when comparing the benefits of both.

Who Are Medical Discount Plans for?

These discount cards may come in handy for people who:

- Don't have health insurance (and can't afford it)

- Have health insurance but a high deductible

- Have a gap in their health coverage

Of course, you also need to be able to afford one of these plans, which is usually less than $50/month.

Medical Discount Programs vs. Health Insurance

There are some key differences between discount health care programs and genuine health insurance policies to be aware of.

Deductibles

First, discount programs don't offer a deductible as health insurance policies do. This is important for those who usually have a lot of medical expenses throughout the year who do meet the deductible. For example, if you have a deductible of $2,000, once you've spent that much on medical services for the year, your insurance will cover the rest of your medical expenses for the year.

If you only have a medical discount plan, there's no deductible, so you'll still be paying out of pocket no matter how much you've spent on medical expenses.

Discounts

Getting a discount is great, isn't it? Although it may seem like a great deal upfront, the benefits you get from a discount plan don't compare to an insurance policy, especially if you have a pretty good policy.

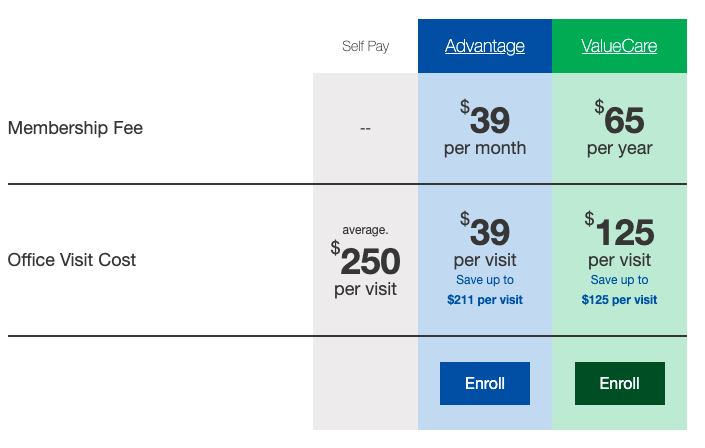

For example, let's look at one particular medical discount provider. They offer a $39/month plan, discounting your medical office visit to just $39/visit.

This is the only benefit they offer. In addition, there are several scenarios they do not cover, including:

- Preventative services (e.g., vaccinations)

- Work-related injuries

- Injuries from car accidents

- Prescription medications

- MRIs, CT scans, ultrasounds

Depending on your health insurance plan, you may also have a copay that you must pay when you visit your doctor, but you'll also have many other benefits

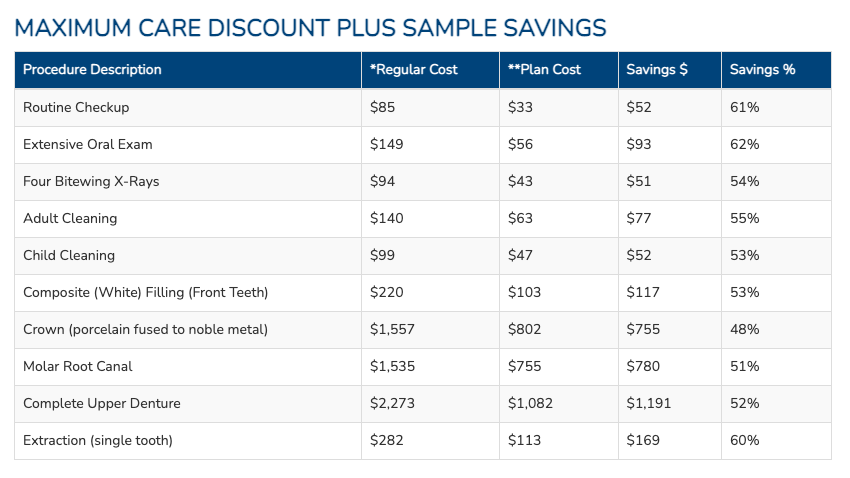

If we look at a different provider who offers dental discounts, you can see how much they cover for specific procedures.

Again, the discounts may look great, but most dental insurance policies cover more. For example, your dental plan likely includes free routine checkups and cleanings twice a year.

Beware of Misleading Offers

Now that you have a better idea of how discount health care programs are different from health insurance policies, you may still be considering getting a discount plan to help you pay for your medical expenses.

Before signing up for any old plan, it's essential to do your research, as several companies don't offer many benefits. There are also many sketchy salespeople out there that will give you misleading information just to make a sale.

Lack of Benefits

Some medical discount plans don't actually offer much in the form of discounts at all. In some cases, you may be paying a monthly fee just to get a discount on a regular visit to your doctor's office. Be sure to understand what kind of discounts are offered and how they compare to what your insurance already covers (if you have insurance).

You'll also want to consider how often you and your family will be using your medical discount cards. If you don't usually have that many medical expenses, it may not be worth paying for an additional plan just for a few discounts.

Fake Medical Discount Plans

Cold calls from discount health care programs are common in the U.S. In some cases, the calls may actually be coming from a scammer trying to trick you into handing over money for a plan that doesn't exist.

Don't Give Payment to Cold Callers

When it comes to insurance and medical discount plans, it's never safe to give your information to someone over the phone, especially if they called you out of the blue. Don't send any payment their way, and don't give your credit card or debit information to them.

There are usually some signs of a scam that you can look out for, including:

- Lack of information about the plan itself

- Pushy sales tactics (e.g., they may offer discounts on your plan)

- Not allowing you time to make a decision or to look over the documentation

- Request for payment using an unusual method (e.g., gift cards, wire transfer, Cash App)

In addition to requesting payment, the scammer may also be phishing for your information. They may ask for your Social Security number (SSN), medicare number, or other sensitive data, which they'll use to steal your identity.

Selling a Medical Discount Plan Like Insurance

A typical sales tactic amongst sketchy marketers is making their discount plans sound like an insurance plan, only much more affordable. So if someone tries to sell you a health insurance policy that only costs $50/month (or less), don't believe them.

On average, health insurance for individuals costs around $450, so a $50 plan just doesn't make sense.

Sales reps will often use different wording for "medical discount plans," instead calling them things like:

- Discount health care policies

- Discount health insurance

- Health discount plans

- Health care discount plans

In some cases, they may be outright misleading and ask you if you want to save on health insurance.

Don't sign up for anything you don't do additional research on first. Ask for information that you can read over in your own time. If they refuse to send you information or give you time to decide, they probably shouldn't be trusted.

Comments