Taxation In Depth

- Taxes and Your Responsibility

- What Are Tax Scams?

- Common Tax Scams to Be Aware of

- Red Flags of TaxScams

- How to Beat Tax Scams

- Fallen Victim to a Tax Scam?

Tax scams are common for one main reason—there are 144.5 million taxpayers in the United States, giving bad actors a broad, diverse threat landscape. Many tax scammers try to leverage the victim’s sense of fear—taxes are unavoidable for many Americans, and mismanaging them can come with stiff penalties.

In other situations, the scammer may try to take advantage of your natural desire for more money, for example by offering a reduction in taxes due for a small fee. Even though tax scammers have a few different weapons, you can thwart their attacks by understanding your tax responsibilities, the different kinds of scams, red flags to look out for, and how to avoid them.

Taxes and Your Responsibility

The Federal government uses the taxes you pay to fund infrastructural improvements, such as roads and parks, education, the military, and essential services for citizens, such as healthcare and Social Security. It’s against the law to not pay your taxes.

Income Tax

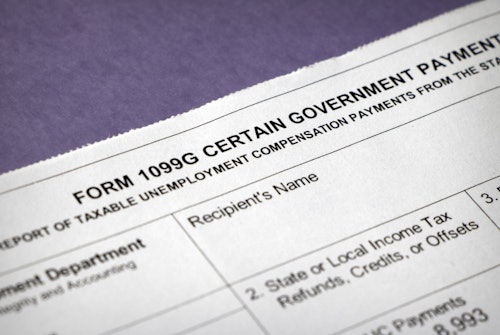

While there are different kinds of taxes, those paid to the Internal Revenue Service (IRS) are typically based on your income. The first step in paying your taxes is to file them, which involves declaring how much you earn. Often, people pay too much in taxes, and this can result in a tax refund, which is when the government gives you some money back after you do your tax return.

Stimulus Checks

The government also uses the tax system to provide citizens with stimulus checks. A stimulus involves giving people money so they can both afford to pay their bills and make purchases that support the general economy. This enables people to keep their jobs and, as a result, infuse more money into the economy.

What Are Tax Scams?

Taxation scams take two basic forms:

- Criminals trying to get you to pay them for fake tax-paying help or services.

- People trying to steal your personal identification information (PII) so they or someone else can steal your identity.

How Tax Scams Work

A thief will pretend to be someone from either the IRS or an organization authorized to help you deal with tax issues. They will then either try to fool you into thinking you have to pay a penalty on taxes you owe or provide them with sensitive information to resolve a tax issue.

In some cases, the “tax issue” they pretend to address involves the government owing you more money than you’ve received from the IRS in a refund. To claim your cash, you have to provide sensitive information. They then use this to steal your identity and open accounts or take out loans in your name.

They’ll usually ask for sensitive information, such as your:

- Social Security number (SSN)

- Full name

- Address

- Names of those in your household

- Contact information

Unfortunately, tax scammers are often successful in their schemes. The FBI recently received about 300,000 complaints in just one year (2020) costing victims a total of $1.3 billion.

Common Tax Scams to Be Aware of

There are several different ways scammers try to target taxpayers, but here are the most common taxation scams to look out for.

Tax-Connected Identity Theft

Identity thieves will try to get you to provide sensitive personal information that can be used to open fraudulent accounts in your name. They then either sell this information to another criminal or use it themselves.

The scam usually starts with the scammer reaching out via email or phone call pretending to be a legitimate representative from the IRS. They ask for your information, with the most important thing being your SSN.

Next, the scammer takes your information and uses it to do one of three things:

- File a fake tax return in your name and send the refund to their bank account.

- Use your personal information to impersonate you in another kind of fraud, such as:

- Taking money from your bank account

- Applying for credit cards in your name

- Applying for Social Security benefits in your name and having payments made to their account

- Applying for loans in your name

- Sell the information to a third party.

Stimulus Payment Scam

A specific kind of identity theft that’s become increasingly common because of the COVID-19 pandemic is one where the criminal tells you you’re due a stimulus payment.

Similar to other kinds of identity theft, the scammers collect personal information and then either sell it, use it to steal from you, or open financial accounts in your name.

Refund Recalculation

In a refund recalculation scam, the thief claims you didn’t get enough money from the IRS in a previous refund. This scam is typically levied using an email that appears to come from the IRS (which may even include its logo) but it could also come via text message.

You’re prompted to click on a link in the email or text, which appears to lead to an IRS website. However, this is a fake site that sends the information you enter to the thieves. After you put in the info the site asks for, scammers either sell it, use it to steal from you, or apply for loans or credit cards.

Tax Scams Involving Gift Card Payments

A gift card scam involves someone pretending to represent the IRS, calling to tell you that you owe money, either from underpayment of taxes or penalties owed. They inform you they will accept your penalty payment using gift cards from certain stores, such as Walmart.

Once you buy the gift cards, the criminal asks for the card number and PIN. They then take that info, make purchases from stores, and either keep or sell the merchandise for profit.

Red Flags of TaxScams

Some of the most common red flags for taxation scams include:

- Emails or calls requesting personal information (the Social Security Administration will never ask for your SSN or other sensitive information via email).

- People saying you can pay for their tax-related services using a gift card (any request for payment via gift card is a scam).

- People calling, texting, or emailing you using threatening, scary language.

In general, this should be a red flag any time someone claims they can help you resolve a tax issue and ask for personal information over email. The IRS doesn’t collect personal info over email.

In addition, any request for personal data, regardless of how the person contacts you, even over the phone, should be a red flag. The IRS already has your personal information, including your Social Security number.

Your Social Security Number Cannot Be Suspended

Many scammers will threaten to suspend your Social Security number unless you pay them. This should flag a scam immediately for you, as your SSN cannot be suspended.

How to Beat Tax Scams

- Don’t give anyone your Social Security number over the phone or email. (Most companies should only need the last four digits.)

- Be careful who you provide your personal information to—always verify their identity first.

- Don’t believe unsolicited calls from the IRS—they will send you mail and only call you if you have an appointment.

- Don’t click on any links in emails or text messages if you can’t verify who they came from. Remember, scammers may make their emails look like legitimate IRS emails.

- If someone from the IRS or Social Security Administration (SSA) calls you, tell them you’ll call them back. Don’t call them back on the number they give you, find the genuine number on the IRS or SSA website.

- Verify that you're on the IRS website (https://www.irs.gov/) before entering any personal information.

Fallen Victim to a Tax Scam?

If you suspect you’ve been targeted by a taxation scam, you should immediately reach out to the IRS at (800)-829-1040 to check whether the communication you received was legitimate or not.

If it wasn’t, you should immediately report the issue by emailing [email protected]. In addition, you should report the incident to:

- The authorities

- The Treasury Inspector General Administration (TIGTA)

- The Federal Trade Commission (FTC)

Getting Your Money Back

If you’ve been targeted by a gift card scam and you’ve already sent the card info to the criminal, you may be able to stop the transaction and get your money back. Contact the company that issued the card and ask them to cancel the transaction. It’s important to do this right away because once the money’s been spent, it may not be possible to get it back.

You may be able to get the funds returned through the criminal justice system if the authorities are able to apprehend the scammer. This is another reason why reporting the incident to the Treasury Inspector General Administration, the FTC, and the IRS is necessary.

If you suspect the scammer may be in your local area, you should report the incident to your local police, who may be able to use your report to track them down.

Protect Yourself from Identity Theft from Tax Scams

If you’ve given the scammer your personal information, it’s important to take the necessary steps to protect yourself from identity theft, which can take years and a lot of hassle to recover from. You should:

- Place a fraud alert on your credit report or freeze your credit completely

- Monitor all of your accounts regularly

- Change all of your passwords (using strong and unique passwords)

- Invest in identity theft protection (it’s worth it!)

Scams Relating to Taxation

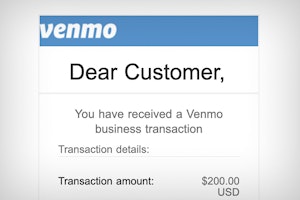

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

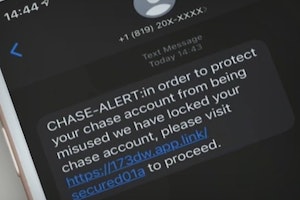

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Truist Text Alert: How to Identify a Real Text from a Scam

You may think that that Truist have sent you a text alert about your account. Here's how to check if it is actually a scam.

Wait! That Walmart Giveaway Text May be a Scam!

Fake texts are being sent to consumers claiming a hefty sum is waiting for them on a Walmart gift card, but falling for this scam puts you at risk of identity theft.

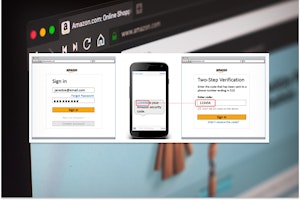

Received an Amazon OTP Text? It Could Be a Scam

If you received an Amazon OTP text message out of the blue, it could be a sign that someone else is trying to log into your account.

Guides Relating to Taxation

Want a Bigger Tax Refund? We've Got You Covered

Americans may see a lower tax refund this year, but we've got a few tips and tricks to get the most out of your 2022 tax return.

How to Choose the Right Tax Preparer for Your 2021 Return

Know what to ask, what to look for, and how to avoid red flags of fraudulent preparers when choosing a tax accountant for your return.

Important Tax Deadlines and Penalties For Your 2021 Returns

It's tax season! Don't get stuck with lofty tax penalties for missing these important dates for filing your return or an extension.

Get The Most Out of Your Return: 14 Tax Deductions & Credits

Don't miss these 14 deductions and credits to lower your tax bill or get more money back on your 2021 tax returns.

How to Get Verified on TikTok

Securing that little blue checkmark can mean brand collabs, sponsorship opportunities, or protecting your unique content from impersonators.

News Relating to Taxation

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.